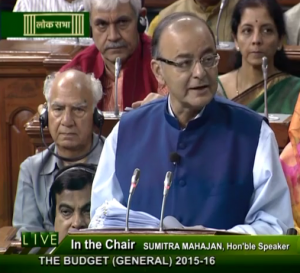

Union Finance Minister Arun Jaitley presented a balanced and unique budget, which has long-term plans and benefits rather than appeasing all. The Union Budget 2015-16 provides enough opportunity to raise funds and put the nation on the path of growth, while tackling the issues of tax evasion and black money with an iron hand.

Union Finance Minister Arun Jaitley presented a balanced and unique budget, which has long-term plans and benefits rather than appeasing all. The Union Budget 2015-16 provides enough opportunity to raise funds and put the nation on the path of growth, while tackling the issues of tax evasion and black money with an iron hand.

FM Speaks:

# In the last 9 months, our government has taken several steps to energise economy: FM.

# Embraced States as equal partners in economic growth: FM.

# We inherited a sentiment of Doom and gloom and have come a long way by pour actions.

# The credibility of Indian economy has been restablished, the World is predicting that it’s India’s chance to fly.

# Modi govt has taken several steps to re-energise economy.

# Objective is to improve quality of life and to pass benefits to common man.

# Three Key Achievements of the Government – Swachh Bharat, Coal Auction and Jan Dhan Yojana.

Union Budget 2015-16 Highlights:

Growth/Fiscal Deficit/Inflation:

# Fiscal deficit seen at 3.9 pct of GDP in 2015/16

# Will meet the challenging fiscal target of 4.1 pct of GDP

# Remain committed to meeting medium term fiscal deficit target of 3 pct of GDP

# Current account deficit below 1.3 percent of GDP

# GDP growth seen at between 8 and 8.5% in 2015-16

# Aiming double digit growth rate, achievable soon

# Expects consumer inflation to remain close to 5% by March

Agriculture:

# Rs. 25,000 crore for Rural Infrastructure Development Bank.

# Rs. 5,300 crore to support Micro Irrigation Programme.

# Farmers credit – target of 8.5 lakh crore.

Infrastructure:

# Rs. 70,000 crores to Infrastructure sector.

# Tax-free bonds for projects in rail road and irrigation

# PPP model for infrastructure development to be revitalised and govt. to bear majority of the risk.

# Rs. 150 crore allocated for Research & Development

# NITI to be established and involvement of entrepreneurs, researchers to foster scientific innovations.

# Govt. proposes to set up 5 ultra mega power projects, each of 4000MW.

Education:

# AIIMS in Jammu and Kashmir, Punjab, Tamil Nadu, Himachal Pradesh, Bihar and Assam.

# IIT in Karnataka; Indian Institute of Mines in Dhanbad to be upgraded to IIT.

# PG institute of Horticulture in Amritsar.

# Kerala to have University of Disability Studies

# Centre of film production, animation and gaming to come up in Arunachal Pradesh.

# IIM for Jammu and Kashmir and Andhra Pradesh.

# Institutions of Science and Educational Research would be set up in Nagaland and Odisha.

Defence:

# Rs. 2,46,726 crore for Defence.

# Focus on Make in India for quick manufacturing of Defence equipment.

Welfare Schemes:

# 50,000 toilets constructed under Swachh Bharath Abhiyan. Target is 6 crore.

# Two other programmes to be introduced- GST & JAM Trinity. GST will be implemented by April 2016.

# MUDRA bank will refinance micro finance orgs. to encourage first generation SC/ST entrepreneurs.

# Housing for all by 2020.

# Upgradation 80,000 secondary schools.

# DBT will be further be expanded from 1 crore to 10.3 crore.

# For the Atal Pension Yojna, govt. will contribute 50% of the premium limited to Rs. 1000 a year.

# Under the Pradhan Mantri Surakhsha Beema Yojana, will cover accidental death risk of Rs 2 lakh for a premium of just Rs 12 per year.

# The Pradhan Mantri Jeevan Jyoti Bima Yojana, will cover both natural and accidental death risk of Rs 2 lakh. The premium will be Rs 330 per year, or less than one rupee per day, for the age group 18-50.

# New scheme for physical aids and assisted living devices for people aged over 80 .

# Govt to use Rs. 9000 crore unclaimed funds in PPF/EPF for Senior Citizens Fund.

# Rs. 5,000 crore additional allocation for MGNREGA.

# Govt. to create universal social security system for all Indians.

# Rs. 75 crore for electric cars production.

# Renewable energy target for 2022: 100K MW in solar; 60K MW in wind; 10K MW in biomass and 5K MW in small hydro power.

Tourism:

# Develpoment schemes for churches and convents in old Goa; Hampi, Elephanta caves, Forests of Rajasthan, Leh palace, Varanasi , Jallianwala Bagh, Qutb Shahi tombs at Hyderabad to be under the new toursim scheme.

# Visa on Arrival for 150 countries.

Taxation:

# Abolition of Wealth Tax.

# Additional 2% surcharge for the super rich with income of over Rs. 1 crore.

# Rate of corporate tax to be reduced to 25% over next four years.

# Total exemption of up to Rs. 4,44,200 can be achieved.

# 100% exemption for contribution to Swachch Bharat and Clean Ganga Project, apart from CSR.

# Service tax increased to 14 per cent from existing 12.36%.

# Transport Allowances doubled from Rs 800 per month to Rs 1,600 per month.

# Medical Allowances increased from Rs 15,000 per annum to Rs 25,000 per annum.

# For Senior Citizens, Medical Allowances increased to Rs 30,000 per annnum.

# Limit on deduction on account of contribution to a pension fund and the new pension scheme is proposed to be increased from Rs 1 lakh to Rs 1.5 lakh.

# Additional deduction of Rs 50,000 will be allowed for contribution to the new pension scheme u/s 80 CCD increasing from Rs 1 lakh to Rs 1.5 lakh.

Black Money Menace:

# A New, Stringent Law, namely Benami Property Transaction Prohibition Bill to be introduced.

# FEMA Act to be amended to incorporate black money provisions.

# Concealment of income assets to get 10-year imprisonment.